High-Performance Matching Engine

Process 100,000+ orders per second with sub-millisecond latency. Price-time priority algorithm ensures fair and efficient order matching.

Deploy a complete cryptocurrency spot exchange with high-performance matching engine, real-time order books, TradingView charts, and 7+ order types. Full source code, unlimited trading pairs, and 3-7 day deployment.

One-time license • Deploy in 3-7 days • Lifetime updates

Experience the real-time order book and price updates

Process 100,000+ orders per second with sub-millisecond latency. Price-time priority algorithm ensures fair and efficient order matching.

Professional-grade charting with 100+ indicators, drawing tools, and multiple timeframes. Full TradingView widget integration included.

WebSocket-powered order book with depth visualization. Updates in real-time with configurable precision and grouping options.

Market, limit, stop-limit, stop-market, OCO, trailing stop, and iceberg orders. All order types configurable per trading pair.

Complete API suite for trading bots and integrations. Real-time WebSocket streams for prices, trades, and order updates.

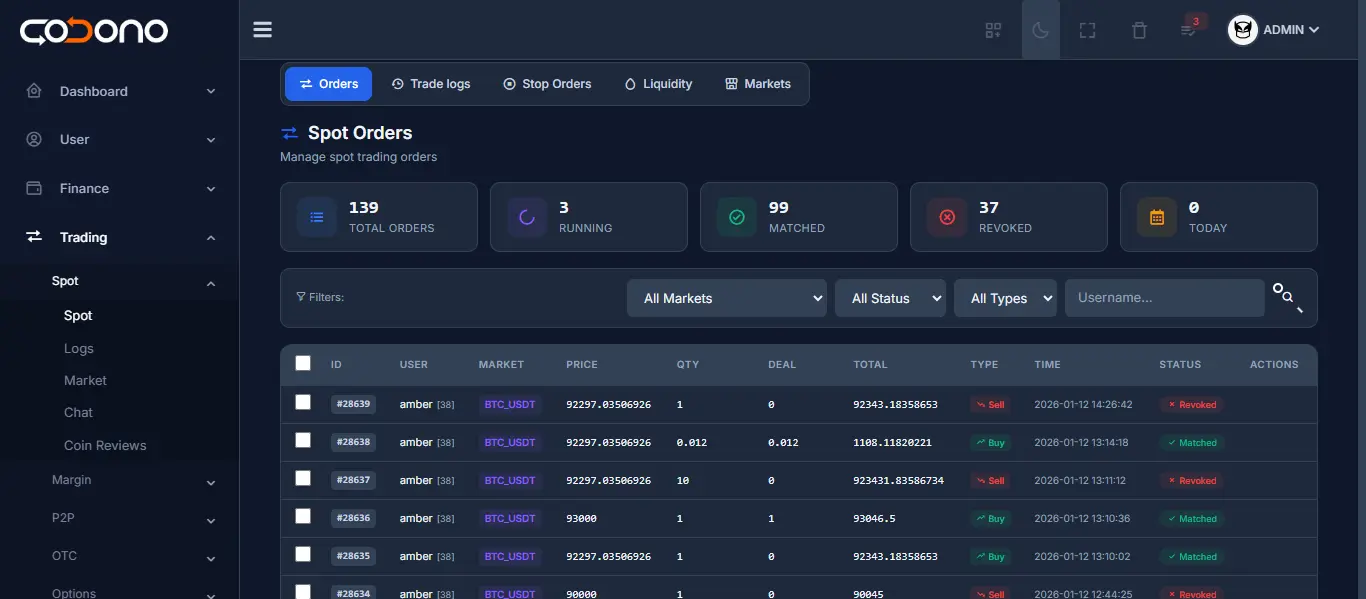

Manage trading pairs, fees, order limits, and market status from the admin panel. No coding required for day-to-day operations.

Complete control over your exchange's trading operations

Execute immediately at best available price. Ideal for fast execution when price is less critical.

Set a specific price. Order executes only when market reaches your price or better.

Trigger a limit order when stop price is reached. Used for entry/exit strategies.

Trigger a market order at stop price. Guarantees execution, not price.

One-Cancels-Other: Place two orders, when one fills the other cancels automatically.

Dynamic stop that follows price movement by a set distance or percentage.

Large order split into smaller visible portions. Hides true order size from market.

Ensures order adds liquidity. Rejected if it would immediately match (taker).

Full REST API for account management, order placement, trade history, and market data. OpenAPI documentation included.

Real-time streams for order book, trades, candlesticks, and user order updates. Low-latency data for trading bots.

Optional FIX 4.4 gateway for institutional traders. Standard protocol used by traditional financial systems.

Dedicated endpoints for market makers. Bulk order placement, position management, and reduced latency.

Spot trading software is the core module that powers buy/sell order matching on a crypto exchange. It includes a high-performance matching engine, real-time order book, TradingView charting integration, multiple order types, trade history, portfolio management, and full admin controls.

The architecture supports unlimited trading pairs. Most operators launch with 50-200 pairs and scale from there. Adding new pairs is done through the admin panel — no coding required.

Market orders, limit orders, stop-limit, stop-market, OCO (one-cancels-other), trailing stop, and iceberg orders. All order types are configurable per trading pair from the admin panel.

The matching engine handles 100,000+ orders per second with sub-millisecond latency. It uses a price-time priority algorithm with atomic order matching and real-time balance updates.

Yes. Full source code access lets you customize the layout, color scheme, widgets, and add your own features. The UI is built with Vue.js components that are easy to modify.

The platform includes market maker tools and API access for liquidity providers. You can also integrate with external liquidity aggregators or run your own market making bots using the provided WebSocket API.

Professional trading interface, high-performance matching engine, and full source code. Deploy in 3-7 days with complete customization.