The Operational Reality of Exchange Infrastructure

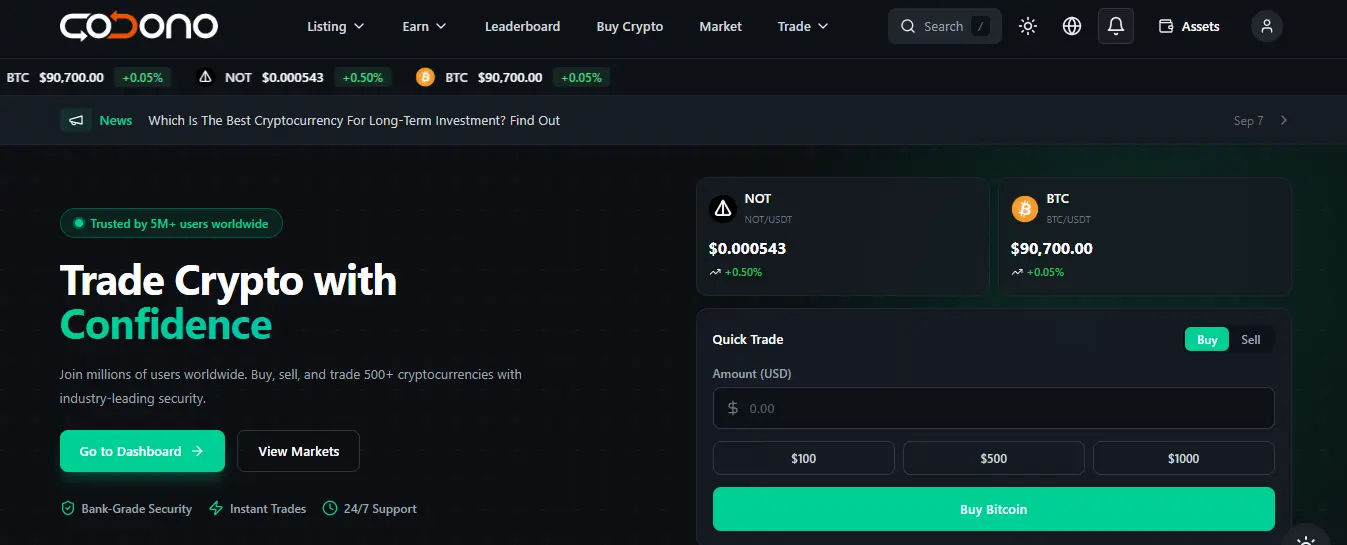

Organizations evaluating cryptocurrency exchange software fall into two categories. The first seeks demonstration projects - platforms that look functional in screenshots and perform adequately with minimal users. The second requires production infrastructure - systems that maintain reliability when markets move 20% in hours, when regulatory auditors request transaction records, when institutional partners conduct due diligence.

This crypto exchange script was built for the second category.

The platform currently processes trading volume for licensed operators across Europe, Southeast Asia, the Middle East, Latin America, and Africa. These are regulated entities answering to financial authorities, institutional liquidity providers, and banking partners. Their requirements shaped the software - not feature checklists, but operational reliability under conditions that reveal whether infrastructure is production-grade or demonstration-ready.

What follows is direct information for operators conducting due diligence on exchange infrastructure investment.

Understanding the Build vs. License Decision

Every exchange operator faces this calculation. The variables are clearer than most vendors acknowledge.

Custom Development Economics

Building institutional-grade cryptocurrency exchange infrastructure from foundation requires:

- Engineering team of 12-20 specialists across trading systems, blockchain integration, security, mobile, and compliance

- Development timeline of 18-30 months from concept to production deployment

- Capital allocation of $800,000-$2,500,000 depending on market and compensation structures

- Additional 12+ months of production hardening as real trading volume reveals edge cases

- Ongoing development costs as regulatory requirements and market standards evolve

Custom development makes economic sense for exchanges targeting $1B+ daily volume with highly differentiated positioning. For regional operators, emerging market entrants, and institutional verticals, the math rarely justifies it.

Production Software Licensing

Licensing proven exchange infrastructure compresses the equation:

- Software investment: $3,000-$13,000 perpetual license

- Deployment and customization: $10,000-$40,000 depending on scope

- Timeline: 14-45 days to production

- Technical team requirements: System administration capability (not trading platform engineering)

The differentiation in your market comes from operations, liquidity relationships, regulatory positioning, and user experience - not from whether you built the matching engine from scratch.

Complete Trading Infrastructure

This section documents actual system capabilities, not marketing feature lists.

Order Execution and Matching

The trading engine processes order flow with sub-second matching across standard order types institutional traders expect:

Supported Order Types

- Market orders with immediate execution

- Limit orders at specified price levels

- Stop-limit orders triggered by market movement

- Stop-market orders for automated position management

- OCO (one-cancels-other) paired instructions

- Post-only orders guaranteeing maker status

- Fill-or-kill orders requiring complete execution

- Immediate-or-cancel orders accepting partial fills

Operational Characteristics

Order matching operates at speeds adequate for regional exchanges processing thousands of concurrent users. This is not high-frequency trading infrastructure competing with co-located execution systems. It is production trading technology handling normal market conditions and moderate volatility events reliably.

Margin Trading Infrastructure

Margin functionality generates revenue through interest income while requiring careful risk management. Implementation details matter.

Risk Architecture

- Isolated margin limiting exposure per position

- Cross margin leveraging entire account

- Configurable leverage ratios (standard 10x, adjustable)

- Real-time margin ratio calculation and monitoring

- Automated liquidation engine with configurable thresholds

- Insurance fund mechanisms protecting against negative balance cascades

Operational Reality

Margin trading is not a feature to enable and forget. Market volatility can trigger liquidation cascades that require operational monitoring and, occasionally, intervention. The system handles mechanics; operators need procedures for extreme market conditions.

Perpetual Futures Contracts

Futures trading generates substantially higher fee revenue per dollar of volume than spot trading. Exchanges serious about profitability build derivatives capability.

Contract Specifications

- Perpetual contracts without expiration

- Leverage configurations up to 100x

- Funding rate mechanism maintaining parity with spot (8-hour intervals)

- Mark price system protecting against manipulation

- Insurance fund absorbing socialized losses

- Auto-deleveraging (ADL) protocols for extreme scenarios

Implementation Considerations

Futures trading amplifies operational complexity. Position monitoring, liquidation management, funding rate calibration, and extreme market procedures require dedicated attention. The software provides robust mechanics; successful operation requires operational commitment.

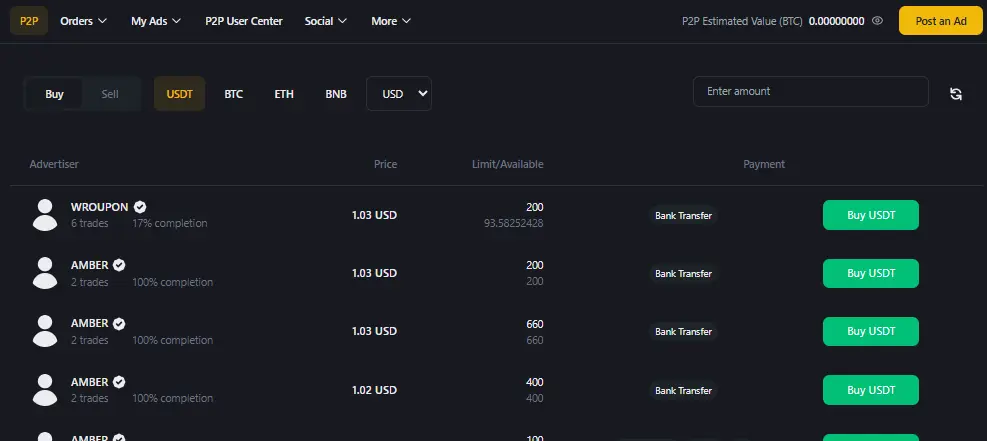

Peer-to-Peer Trading Marketplace

P2P functionality enables fiat on-ramp and off-ramp without requiring direct banking relationships - essential for operators in markets with limited traditional financial infrastructure access.

Core Functionality

- Time-bounded escrow with automatic release conditions

- Multi-step dispute resolution with evidence documentation

- Merchant verification and tiered trust levels

- Payment method management across 100+ options

- Real-time messaging with moderation tools

- Trade completion metrics and reputation tracking

Compliance Considerations

P2P platforms face specific regulatory scrutiny. The system includes transaction monitoring, suspicious activity flagging, and audit trails designed for regulatory compliance. Operators must implement appropriate compliance frameworks for their jurisdictions.

Multi-Asset Wallet Infrastructure

Cryptocurrency wallet systems fail silently in poorly engineered software. Deposits miss, withdrawals process incorrectly, balances drift from blockchain state. This infrastructure was built by engineers who understand blockchain transaction mechanics at protocol level.

Supported Networks

- Bitcoin and UTXO-based networks

- Ethereum and EVM-compatible chains

- Binance Smart Chain, Polygon, Avalanche

- Solana

- Tron

- TON (Telegram Open Network)

- 500+ tokens across supported networks

Operational Features

- Automatic deposit detection with confirmation tracking

- Hot/cold wallet separation with configurable thresholds

- Withdrawal approval workflows with multi-level authorization

- Address validation preventing incorrect network transactions

- Balance reconciliation and audit tooling

- Comprehensive transaction logging

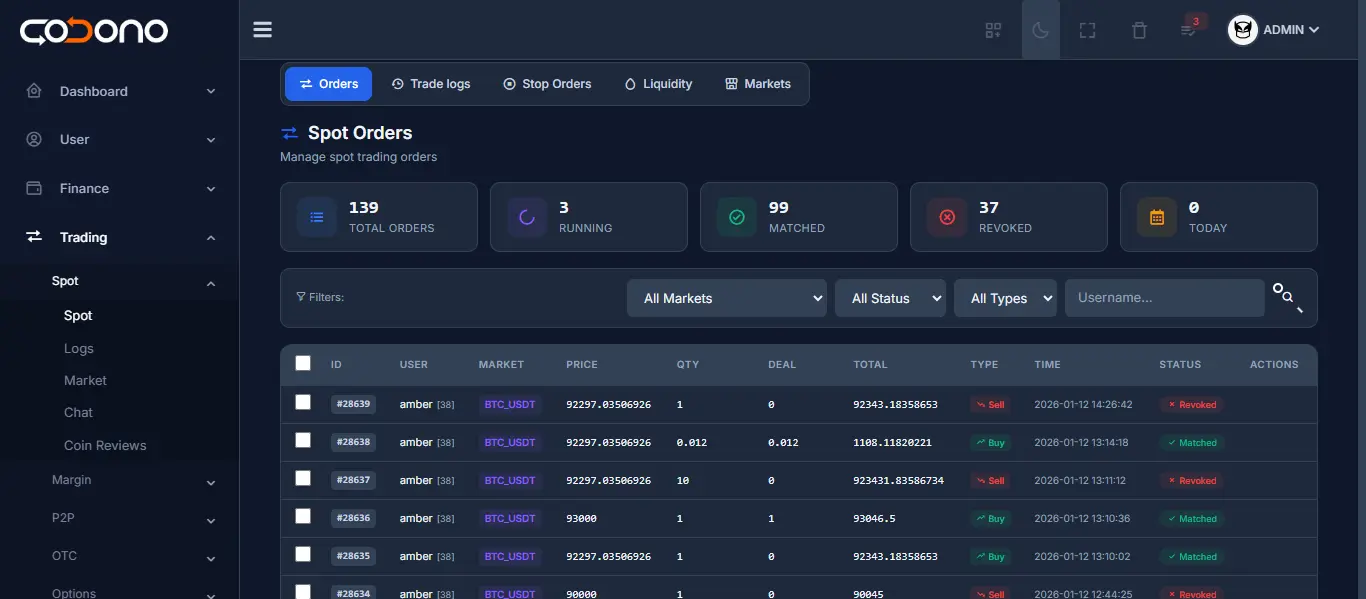

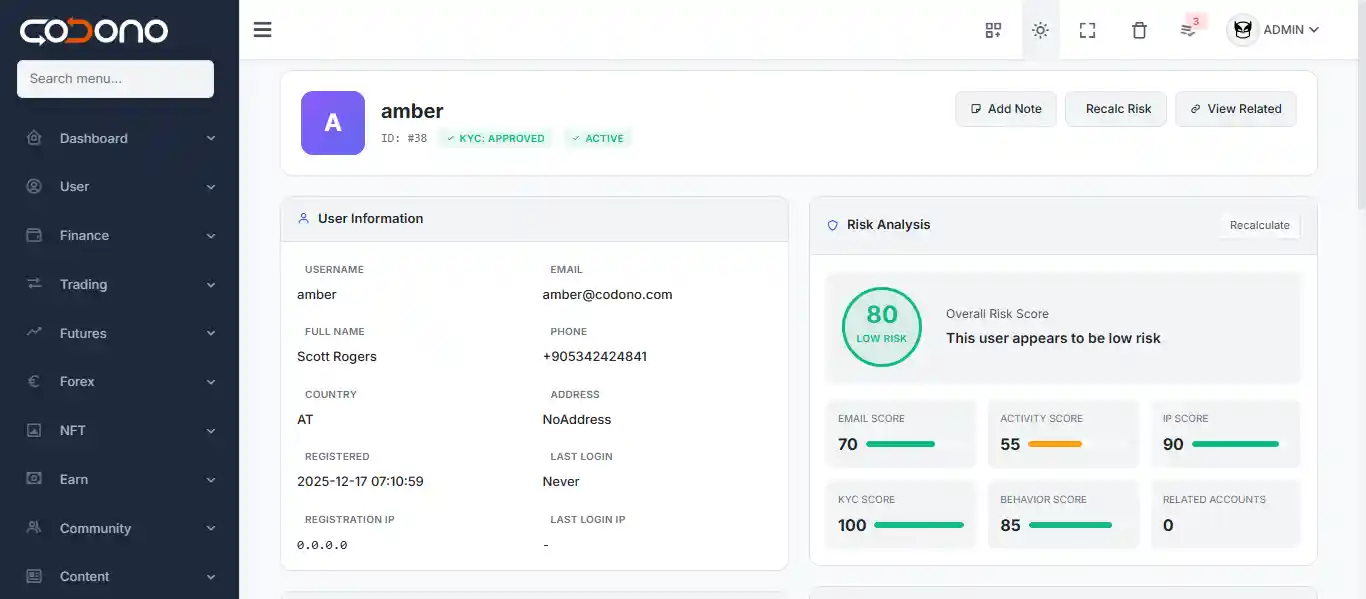

Administrative Operations Center

The administrative interface is designed for daily operations, not demonstration screenshots.

User Operations

- KYC verification queue with document review interface

- Account status management and investigation tools

- Manual balance adjustment with audit logging

- Trading limit configuration by verification tier

- Complete activity logging and session history

- Suspicious activity flagging and investigation

Financial Operations

- Real-time wallet balance monitoring

- Withdrawal approval and processing queues

- Deposit monitoring with manual crediting capability

- Fee collection and revenue reporting

- Profit and loss analysis by trading pair

- Settlement and reconciliation tools

Market Operations

- Trading pair configuration and management

- Dynamic fee structures by pair, volume, and user tier

- Market maker and liquidity configurations

- Circuit breaker and trading halt controls

- Maintenance mode management

- Announcement and notification systems

Native Mobile Applications

iOS and Android applications with full trading functionality, not web wrappers presenting mobile-unfriendly interfaces.

Platform Capabilities

- Complete spot trading functionality

- Margin and futures trading (where licensed)

- P2P marketplace access

- Biometric authentication (Face ID, fingerprint)

- Push notifications for trades, deposits, price alerts

- QR code scanning for address input

- Portfolio management and analytics

App Store Considerations

Cryptocurrency applications face heightened scrutiny during app store review. Native applications built with appropriate permissions and clear financial functionality have substantially higher approval rates than hybrid or web-wrapper approaches. We have extensive experience navigating these review processes.

Liquidity Architecture

New exchanges face a structural challenge: traders require liquidity, but liquidity requires traders. This system includes infrastructure addressing this cold-start problem.

Aggregated Liquidity

Built-in connectivity to major global trading venues mirrors order book depth on your platform. Your users see competitive market prices and execute trades at market rates from day one.

Flow Routing

When users place orders:

- System checks internal order book for matches

- Matched orders settle within your platform

- Unmatched orders route to external liquidity

- Your platform captures spread and commission

Evolution Path

As organic trading volume develops, increasing order flow settles internally. Operators can develop proprietary market making relationships over time while maintaining external liquidity as backup.

Revenue Model for Exchange Operators

Transparency about economics helps qualified operators make informed decisions.

Primary Revenue Streams

| Source | Typical Rate | Notes |

|---|---|---|

| Spot Trading Fees | 0.1% maker/taker | $1,000 per $1M volume |

| Futures Trading Fees | 0.02%/0.05% | Higher volume compensates lower rate |

| Margin Interest | Variable | Daily interest on borrowed positions |

| Withdrawal Fees | Network cost + margin | Standard industry practice |

| Listing Fees | $10,000-$500,000 | Market dependent |

| P2P Commissions | 0.1-0.5% | Per completed trade |

Illustrative Projection

A regional exchange processing $10M daily volume at standard fee rates generates approximately $10,000 daily in trading fees alone - $300,000+ monthly before secondary revenue streams.

Security Architecture

Security in exchange operations is not a feature - it is an ongoing discipline. The software provides tools; operators implement practices.

User-Facing Security

- Two-factor authentication (TOTP with SMS fallback)

- Anti-phishing codes for email verification

- Login notification and session management

- Withdrawal address whitelisting

- Time-delayed withdrawals for new addresses

Platform Security

- DDoS mitigation infrastructure

- Web application firewall protection

- Request rate limiting and abuse prevention

- Input validation and injection prevention

- Cross-site scripting protections

Wallet Security

- Hot/cold wallet separation

- Multi-signature transaction requirements (configurable)

- Key encryption at rest

- Comprehensive audit logging

- Reconciliation tooling

Critical Understanding

No exchange software prevents compromise through poor operational security. Key management, access controls, employee vetting, and security procedures determine actual security posture. We provide capable tools and documented procedures; implementation discipline remains your responsibility.

Deployment Process

Phase 1: Infrastructure (Days 1-5)

- Server provisioning and configuration

- Database deployment

- SSL and domain configuration

- Base software installation

- Network and firewall setup

Phase 2: Configuration (Days 6-12)

- Branding implementation

- Trading pair configuration

- Fee structure setup

- KYC provider integration

- Payment method configuration

Phase 3: Testing (Days 13-18)

- Functional verification across modules

- Security scanning and assessment

- Performance testing under load

- Mobile application verification

- User acceptance testing

Phase 4: Launch (Days 19-21)

- Production deployment

- Administrative team training

- Monitoring and alerting activation

- Go-live coordination

- Initial operational support

Timelines compress or extend based on customization scope and operator preparation.

Operator Requirements and Fit

This infrastructure is designed for specific operator profiles.

Appropriate For

- Licensed exchange operators or license applicants

- Regulated financial institutions entering digital assets

- Funded ventures with institutional backing

- Established trading businesses expanding into cryptocurrency

- Regional operators serving underbanked markets

Not Appropriate For

- Hobbyist projects or educational experiments

- Operators unwilling to invest in compliance infrastructure

- Organizations without system administration capability

- Businesses expecting high-frequency trading performance

- Operators seeking to build the next global exchange leader

Beginning the Evaluation Process

Qualified operators typically follow this path:

- Access the Demonstration Environment - Interact with production software as a user

- Review Licensing Options - Understand investment requirements

- Technical Discussion - Address specific deployment questions

- Due Diligence - Reference calls, security review, compliance alignment

- Licensing and Deployment - Execute and launch

We’ve deployed exchange infrastructure for 100+ operators across 30+ countries. Not all achieved commercial success - exchange businesses depend on marketing, operations, regulatory environment, and market timing. None failed because the trading infrastructure couldn’t handle production requirements.

For operators conducting serious due diligence on cryptocurrency exchange infrastructure, contact our enterprise team to discuss your specific operational requirements.