Multi-Exchange Aggregation

Connect to Binance, OKX, Bybit, KuCoin, Kraken, and DEX aggregators. Aggregate order books from multiple sources into a single deep liquidity pool with unified pricing.

Launch your crypto exchange with deep liquidity from day one. Aggregate order books from major CEX and DEX venues, route orders intelligently across sources, and manage market making programs:all with full source code and admin controls.

One-time license • Deploy in 3-7 days • Lifetime updates

From fragmented venues to unified order book execution

Integrate with CEXs and DEX aggregators via WebSocket/REST APIs

SOR evaluates price, fees, and depth:splits orders for best execution

Deep combined liquidity with tight spreads and minimal slippage

Connect to Binance, OKX, Bybit, KuCoin, Kraken, and DEX aggregators. Aggregate order books from multiple sources into a single deep liquidity pool with unified pricing.

Cost-aware execution that factors in maker/taker fees, expected slippage, and available rebates. Split orders across multiple venues for optimal fills on larger trades.

Configure minimum spreads per trading pair. The engine automatically adjusts quotes based on market conditions, volatility, and your profit targets.

Deploy quoting strategies with configurable spread adjustment, inventory bands, and hedging targets. Built-in circuit breakers protect against adverse moves during volatility.

Manage liquidity provider relationships with custom tiers, rebates, and fee structures. Track fill ratios, quote adherence, and generate performance reports.

Set position limits, exposure caps, and hedging rules. Monitor P&L in real-time with automatic risk alerts and circuit breakers for protection.

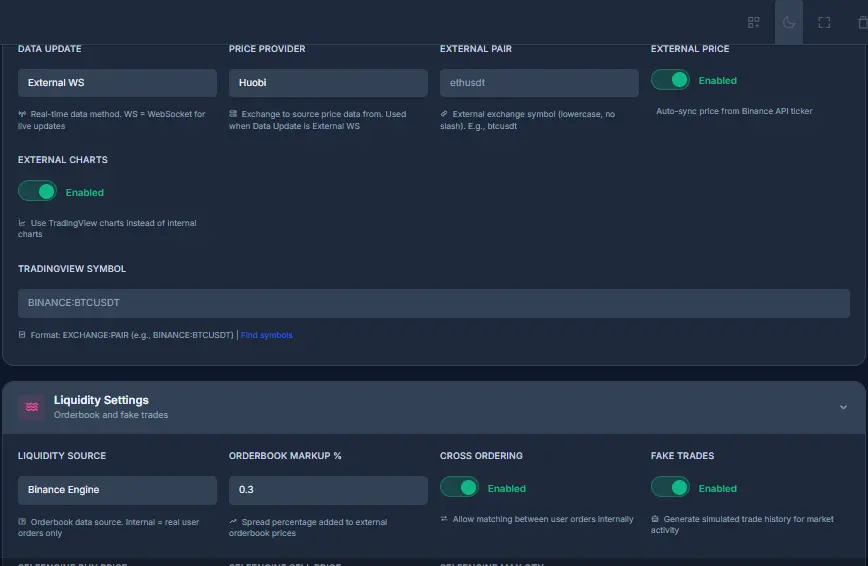

Complete control over liquidity sources and trading parameters

Connect to major exchanges out of the box, or add custom sources

The engine connects to multiple external exchanges via API (Binance, OKX, Bybit, etc.) and aggregates their order books in real-time. Orders on your exchange are matched against this combined liquidity pool, ensuring users get the best available prices.

Yes, the liquidity engine is optional. You can operate with purely organic liquidity from your users, or use a hybrid approach where external liquidity fills gaps while organic trading grows.

Pre-built connectors are included for Binance, OKX, Bybit, KuCoin, and Kraken. The modular architecture allows adding custom connectors for any CEX with a public API, DEX aggregators, or DeFi protocols via REST, WebSocket, or FIX adapters.

The SOR engine evaluates orders against price, fees, expected slippage, and liquidity depth across all connected venues. It can split orders across multiple sources for optimal execution, factoring in maker/taker fees and available rebates.

Configure minimum spreads per trading pair from the admin panel. The engine automatically adjusts quotes based on market conditions, volatility, your profit targets, and risk parameters you define.

The engine is optimized for speed with sub-10ms aggregation latency. Smart caching, WebSocket connections to liquidity sources, and efficient order routing minimize any delay.

Yes, the platform includes market maker tools with configurable strategies. Set up quoting engines with parameters for spread adjustment, inventory management, and hedging. Built-in circuit breakers protect against adverse moves during volatility.

Yes. Define custom tiers, rebates, and fee structures for liquidity providers. Track fill ratios, quote adherence, and generate performance reports for your LP relationships.

Professional liquidity aggregation, smart order routing, market making tools, and full source code. Deploy in 3-7 days with complete admin controls.