Complete Margin Trading for Crypto Exchanges

Launch your own crypto margin trading exchange with up to 10x leverage. White-label margin trading software with isolated/cross margin modes, automated liquidation engine, and complete admin controls. Full source code included.

Complete Margin Trading Features

Everything you need to offer professional leverage trading

Configurable Leverage

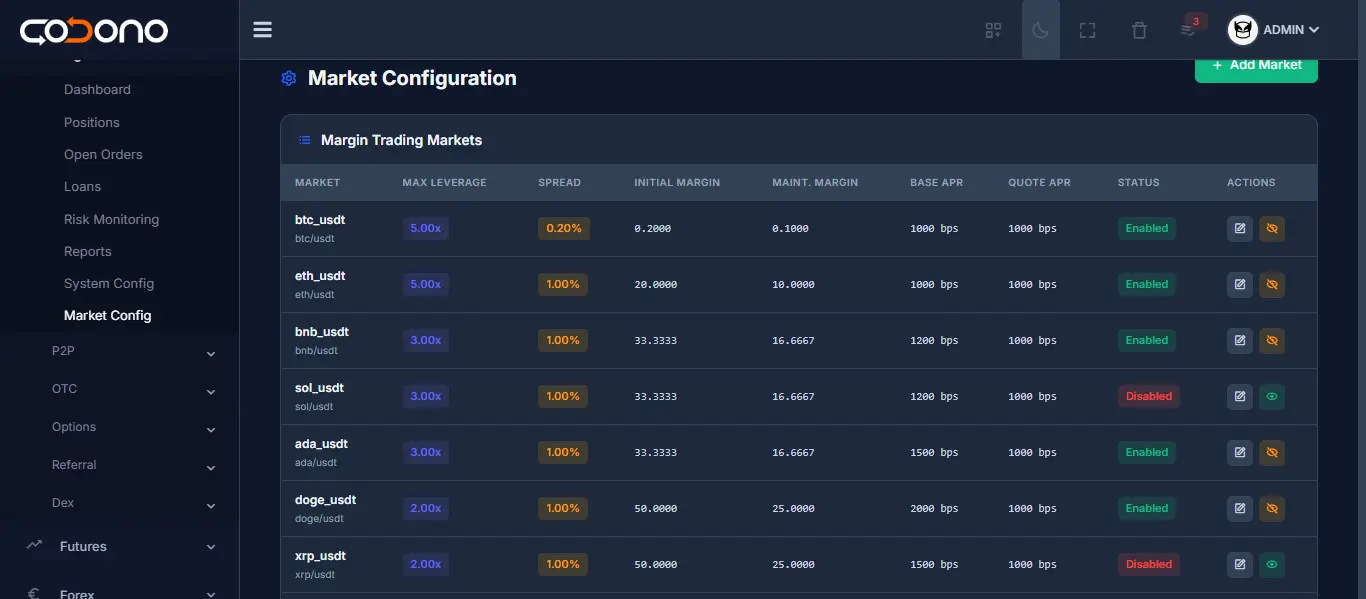

Set leverage from 2x to 10x per trading pair. Admin controls allow you to adjust leverage limits based on market conditions and user tiers.

Isolated & Cross Margin

Support both isolated margin (risk per position) and cross margin (shared collateral) modes. Users choose based on their trading strategy.

Automated Liquidation Engine

Real-time margin monitoring with configurable liquidation thresholds. Partial liquidation protects users while managing platform risk.

Risk Management Suite

Stop-loss, take-profit, and trailing stop orders built-in. Margin call alerts at configurable levels (e.g., 80%, 100%, 120%).

Interest Rate Management

Set hourly/daily borrowing rates per asset. Auto-calculate and deduct interest fees. Full transparency in user interface.

Margin Wallet System

Dedicated margin wallets with transfer controls. Users move funds between spot and margin wallets with configurable limits.

How Margin Trading Works

User flow from deposit to trade

Transfer to Margin

Users transfer funds from spot wallet to margin wallet with one click

Select Leverage

Choose leverage (2x-10x) and margin mode (isolated or cross)

Open Position

Place long or short orders with automatic margin calculation

Manage & Close

Monitor P&L, set stop-loss, and close positions to realize profits

Professional Trading Interface

Your users get a complete margin trading experience with all the tools they need.

- Real-time P&L tracking with liquidation price

- Leverage slider with position calculator

- Stop-loss and take-profit order types

- Margin mode toggle (isolated/cross)

- Open positions table with close buttons

- Trade history and funding rate display

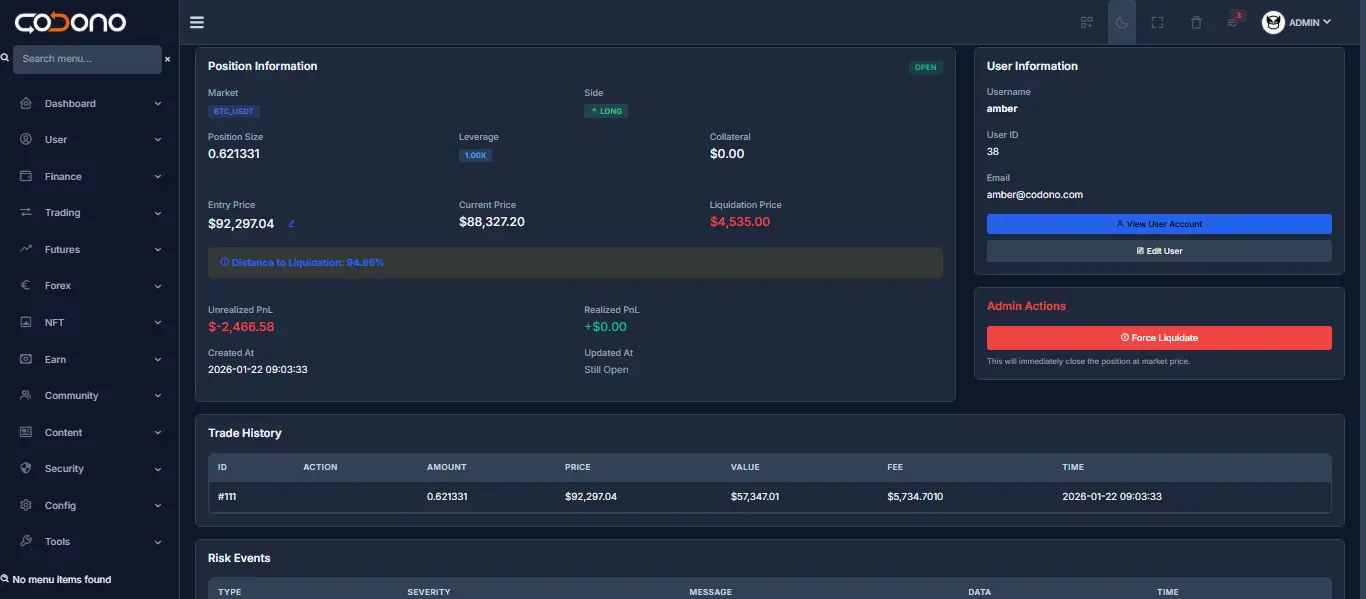

Complete Admin Control

Manage every aspect of margin trading from your admin panel

Leverage Configuration

- Set max leverage per trading pair

- User tier-based leverage limits

- Dynamic leverage adjustment

- Maintenance margin settings

Risk Parameters

- Liquidation threshold configuration

- Margin call alert levels

- Maximum position size limits

- Platform exposure monitoring

Interest & Fees

- Hourly/daily interest rates

- Per-asset borrowing fees

- Trading fee configuration

- Interest accrual schedules

Monitoring & Reports

- Real-time position tracking

- Liquidation event logs

- Revenue analytics dashboard

- Risk exposure reports

Built-in Risk Management

Protect your platform and users with comprehensive risk controls.

Margin Call Alerts

Multi-level warnings at 80%, 100%, 120% margin levels

Partial Liquidation

Gradual position reduction instead of full liquidation

Position Limits

Maximum position size per user and per market

Exposure Monitoring

Real-time platform-wide risk dashboard for admins

Frequently Asked Questions

User flow from deposit to trade

What is margin trading software and how does it work?

Margin trading software enables cryptocurrency exchanges to offer leveraged trading, allowing users to borrow funds to increase their position size. Codono's margin trading platform supports 2x-10x leverage with both isolated and cross margin modes, automated liquidation, and comprehensive risk management.

What leverage options does this crypto margin exchange support?

The platform supports configurable leverage from 2x to 10x. You can set different maximum leverage levels per trading pair and per user tier through the admin panel. This flexibility allows you to manage risk while providing competitive leverage options.

How does the automated liquidation engine protect my exchange?

The liquidation engine monitors all positions in real-time. When margin level drops below the maintenance threshold, partial liquidation begins automatically. Users receive alerts at configurable margin levels (e.g., 80%, 100%) before liquidation, protecting both users and your platform from excessive losses.

What's the difference between isolated and cross margin trading?

Isolated margin limits risk to a single position - if that position is liquidated, only the margin allocated to it is at risk. Cross margin shares collateral across all positions, offering more efficient capital use but higher overall risk. Our margin trading software supports both modes.

Can I customize the margin trading interface for my brand?

Yes, Codono's white-label margin trading software is fully customizable. You receive complete source code, allowing you to modify the UI, branding, colors, and features to match your exchange's identity. No recurring licensing fees or revenue sharing.

How are borrowing interest rates managed in the platform?

Admins set borrowing interest rates per asset through the admin panel. Rates can be hourly or daily, and interest is automatically calculated and deducted from user accounts. This provides a revenue stream while maintaining transparency for your users.

Is the margin trading module included with the exchange software?

Yes, the margin trading module is included with all Codono cryptocurrency exchange packages at no additional cost. You get the complete leverage trading functionality with full source code and admin controls.

How long does it take to launch a margin trading platform?

With Codono's pre-built margin trading software, you can launch in 3-7 days. The platform comes ready with all essential features including leverage controls, liquidation engine, risk management, and user interface - just configure your settings and deploy.

Add Margin Trading to Your Exchange

The margin trading module is included with Codono exchange software. Get complete leverage trading functionality with full source code and admin controls.