7 Crypto Exchange Trends That Will Define 2026

The Exchange Landscape Is Unrecognizable From Two Years Ago

If you launched a crypto exchange in 2024 and haven’t changed anything since, you’re already falling behind.

The last 18 months have been the most transformative period in crypto exchange history. MiCA went live across Europe. The US finally started providing regulatory clarity (sort of). Institutional adoption went from “we’re exploring blockchain” to actual deployed capital. And user expectations shifted from “it works” to “it works like Binance or I’m leaving.”

We’ve been building crypto exchange software at Codono since 2018, and we’ve watched hundreds of exchanges navigate these shifts. Some adapted brilliantly. Others got caught flat-footed. The difference almost always comes down to whether operators saw the trends coming or got surprised by them.

Here are the seven trends that will define 2026 — and what smart exchange operators are doing about each one.

1. Regulatory Compliance Is No Longer Optional — It’s a Competitive Advantage

Two years ago, compliance was something exchange operators did reluctantly. The attitude was: “We’ll deal with regulation when we have to.” That era is definitively over.

In 2026, compliance has flipped from cost center to competitive moat. Here’s why: as regulators tighten the screws on unlicensed exchanges, the operators who already have their KYC/AML infrastructure sorted are picking up the displaced users. We’ve seen Codono-powered exchanges report 40-60% user growth simply because competitors in their market got shut down or restricted.

What’s actually happening:

- MiCA enforcement is fully active across the EU. Exchanges without proper licensing are being actively blocked. The ones that prepared early now have a massive first-mover advantage in the world’s second-largest crypto market.

- Travel Rule compliance is becoming universal. If your exchange can’t transmit originator and beneficiary data on transactions above $1,000, you’re going to lose banking partners.

- Proof of Reserves shifted from PR stunt to regulatory requirement in several jurisdictions. Exchanges need real-time auditable reserve data.

What smart operators are doing: They’re investing in compliance infrastructure before it’s mandated. Integration with providers like Sumsub handles identity verification across 220+ countries. Automated transaction monitoring catches suspicious activity before regulators come asking questions. The exchanges treating compliance as a marketing feature — “We’re licensed, regulated, and your funds are verifiably safe” — are winning the trust war.

The bottom line: every dollar you spend on compliance today is worth ten dollars in avoided fines, preserved banking relationships, and user trust tomorrow.

2. The Rise of Hybrid Exchanges: CEX Meets DEX

The “CEX vs DEX” debate is over. The answer is both.

Users want the speed and UX of centralized exchanges with the self-custody and transparency of decentralized ones. And in 2026, the technology finally exists to deliver that.

What hybrid actually looks like in practice:

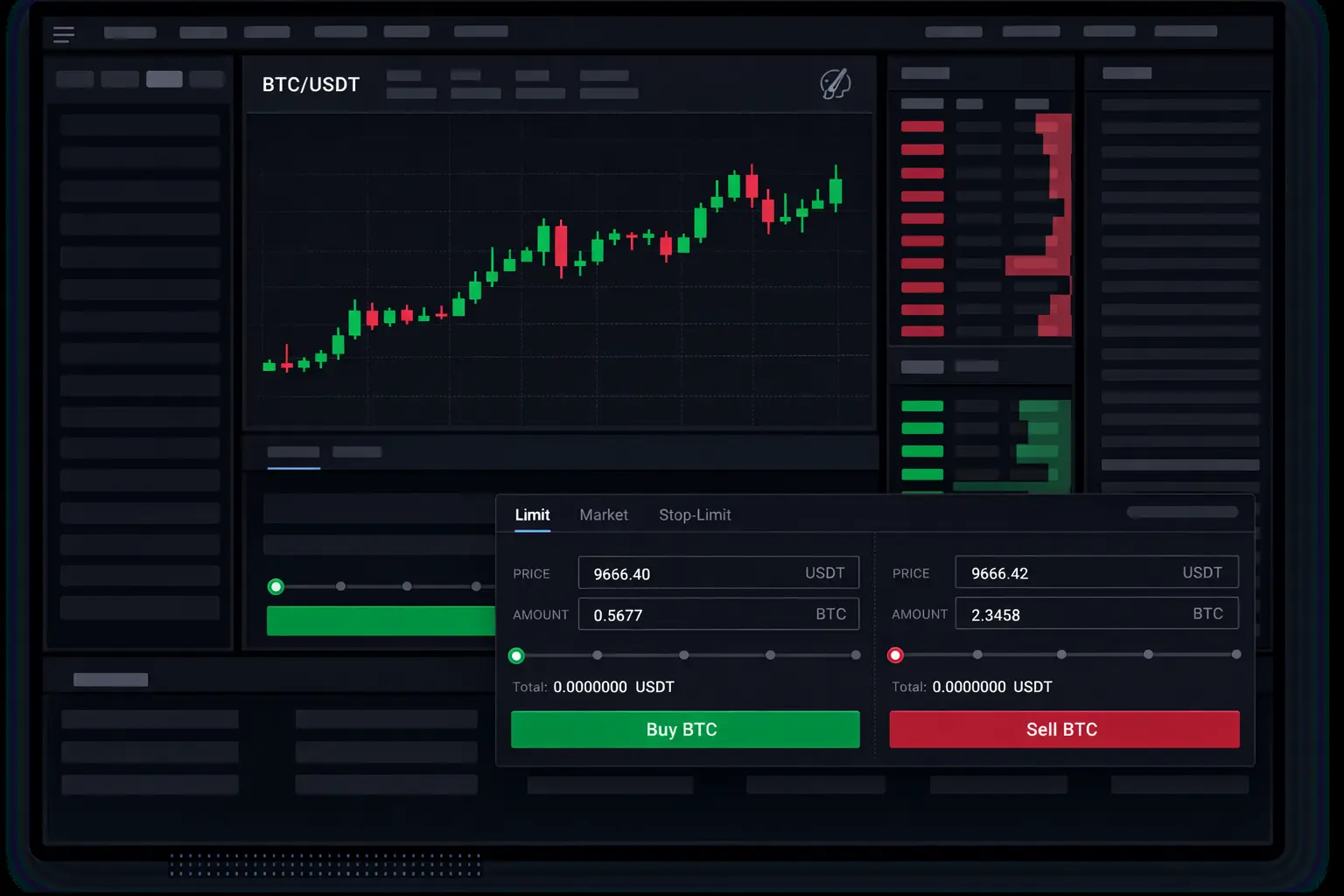

- Centralized order matching for speed (microsecond execution via the trading engine)

- On-chain settlement for transparency

- Optional self-custody wallets alongside custodial accounts

- DEX aggregation for exotic token pairs the exchange doesn’t natively list

We’re seeing this play out in real time. Exchange operators using Codono’s white-label solution are integrating DEX liquidity feeds alongside their centralized order books. The user doesn’t even notice the difference — they place an order, it gets filled at the best price whether that comes from the CEX order book or a DEX aggregator.

Why this matters for your exchange: Users who want full KYC’d accounts can have them. Users who prefer non-custodial trading can have that too. You capture both segments instead of losing half your potential market to the other model.

3. AI-Powered Trading Features Are Becoming Table Stakes

This is the trend that’s moving fastest. A year ago, AI in crypto trading was a novelty. In 2026, exchanges without AI-assisted features are starting to feel… dated.

What’s actually working (not hype):

- AI-powered risk management: Real-time detection of unusual trading patterns, potential wash trading, and market manipulation. This isn’t just about compliance — it protects your exchange from the kind of incidents that make headlines.

- Smart order routing: AI that analyzes order book depth, spread, and historical fill rates to route orders for optimal execution. Users get better fills. Your exchange gets a reputation for excellent execution quality.

- Personalized trading insights: Instead of showing every user the same dashboard, AI-driven interfaces that surface relevant market data, alerts, and opportunities based on individual trading patterns.

- Automated customer support: AI chatbots that can handle 80% of support tickets (balance inquiries, KYC status, deposit tracking) without human intervention. Your support team focuses on the complex issues that actually need human judgment.

The key insight: You don’t need to build any of this yourself. Most of it plugs into existing exchange infrastructure via APIs. The exchanges winning on AI aren’t the ones with the biggest ML teams — they’re the ones that integrate the best tools fastest.

4. Mobile-First Is Now Mobile-Only for Most Users

Here’s a stat that should make every exchange operator think: 73% of crypto trades on retail exchanges in 2026 are executed on mobile devices. Not “mobile-responsive websites” — actual native mobile apps.

If your exchange doesn’t have a dedicated mobile trading app, you’re invisible to nearly three-quarters of your potential users. That’s not an exaggeration.

What mobile-first exchanges are doing differently:

- Biometric authentication (Face ID, fingerprint) instead of painful 2FA flows that make users abandon the login screen

- Push notifications for price alerts, order fills, and deposit confirmations that keep users engaged

- Simplified trading interfaces for mobile with one-tap buy/sell alongside advanced charting for power users

- In-app staking and earning features that turn passive users into daily active users

The exchanges seeing the highest retention rates in 2026 are the ones treating their mobile app as the primary product, not an afterthought. Desktop is for power traders. Mobile is for everyone else — and “everyone else” is the majority of your revenue.

5. Derivatives and Futures Are Where the Volume Is

Spot trading is still the foundation, but futures trading now accounts for over 75% of total crypto trading volume globally. If your exchange only offers spot, you’re leaving the vast majority of potential revenue on the table.

The derivatives opportunity in 2026:

- Perpetual futures remain the dominant product. Traders love the leverage and the ability to go long or short without expiry dates.

- Options trading is the next frontier. Still early, but growing rapidly as more sophisticated traders enter the market.

- Tokenized derivatives — synthetic exposure to stocks, commodities, and forex pairs via crypto — are opening entirely new markets.

What this means for new exchange operators: You don’t need to launch with a full derivatives suite. But you need a technology platform that supports it when you’re ready. Exchanges built on Codono can activate futures trading and margin trading modules without rebuilding their infrastructure. That upgrade path matters more than most founders realize at launch.

Risk management is critical: The exchanges getting into trouble with derivatives are the ones with inadequate risk engines. Liquidation cascades, socialized losses, auto-deleveraging failures — these aren’t theoretical problems. They’re the things that killed FTX and continue to blow up under-capitalized exchanges. Invest in your risk engine or don’t offer leverage. There’s no middle ground.

6. Liquidity-as-a-Service Is Solving the Chicken-and-Egg Problem

The single biggest reason new exchanges fail is the liquidity problem. No traders come because there’s no liquidity. There’s no liquidity because no traders come. It’s a death spiral that kills exchanges before they ever get a chance to prove themselves.

In 2026, the solution has matured significantly. Liquidity aggregation services now make it possible for a brand-new exchange to launch with Binance-level order book depth from day one.

How liquidity-as-a-service works:

- Your exchange connects to one or more liquidity providers via API

- The providers stream live order book data to your exchange

- When a user places an order, it gets filled against the aggregated liquidity pool

- The user sees tight spreads and instant fills, as if your exchange has thousands of active traders

- You earn the spread between provider price and user price

The economics are compelling: Instead of spending $50K-$100K per month on market-making agreements (the old approach), exchanges can access deep liquidity for a fraction of that cost. We’ve seen Codono-powered exchanges go from zero to $10M daily volume within weeks of launch using integrated liquidity engines.

The key gotcha: Not all liquidity providers are created equal. Some offer phantom liquidity that disappears during volatile markets — exactly when your users need it most. Vet your providers carefully. The best ones guarantee liquidity even during high-volatility events.

7. Multi-Chain Is Non-Negotiable

The days of “we only support Ethereum” are long gone. In 2026, users expect their exchange to support every major blockchain, and they expect deposits and withdrawals to be fast and cheap regardless of which chain they’re using.

The minimum viable blockchain support in 2026:

- Bitcoin (obviously)

- Ethereum (and all major ERC-20 tokens)

- Solana (exploded in usage, can’t ignore it)

- BNB Chain (massive DeFi ecosystem)

- Tron (dominant for USDT transfers in Asia)

- Polygon, Avalanche, TON (growing ecosystems)

The operational challenge: Every blockchain you support adds operational complexity. Different node software, different wallet architectures, different confirmation times, different fee structures. Supporting 10+ blockchains without dedicated infrastructure is a nightmare.

This is exactly why most exchange operators use pre-built wallet systems rather than building their own. Codono’s multi-chain wallet infrastructure handles the complexity under the hood — new chain support gets added at the platform level, and individual exchanges get it automatically.

What’s coming next: Cross-chain bridging directly within exchange interfaces. Users will deposit on one chain and withdraw on another without even thinking about which chain they’re on. The exchanges that make multi-chain invisible to users will win.

The Meta-Trend: Speed to Market Wins

If there’s one overarching lesson from all seven of these trends, it’s this: the exchanges that adapt fastest win. Not the ones with the most features. Not the ones with the biggest budgets. The ones that see where the market is going and get there first.

This is why white-label exchange solutions have dominated the market. An exchange operator using Codono can launch with spot trading, add futures in month three, integrate AI risk management in month five, and roll out a mobile app in month seven. A custom-built exchange is still debugging their matching engine at month seven.

Speed isn’t everything. But in a market moving this fast, it’s close.

What Should You Do Right Now?

If you’re planning to launch a new exchange in 2026, here’s the priority order:

- Get your licensing sorted first. Pick a jurisdiction, start the process. Don’t build anything until you know where you’ll operate.

- Choose a technology platform that supports all seven trends. You don’t need every feature at launch, but you need the architecture to add them without starting over.

- Solve liquidity before you launch. Not after. Before. Nobody will use an exchange with empty order books.

- Launch with mobile from day one. Not “we’ll add mobile later.” Day one.

- Build compliance into your DNA. It’s cheaper and easier to start compliant than to retrofit compliance later.

The crypto exchange market in 2026 is more competitive than ever. But it’s also bigger than ever. The opportunity is massive for operators who move fast, stay compliant, and keep adapting.

Want to see how Codono can help you capitalize on these trends? Request a demo or view our pricing to get started.

The Codono Team has been building crypto exchange infrastructure since 2018, powering 500+ exchanges across 40+ countries. We write about what we’ve actually seen work — not what sounds good in a pitch deck.