Document Verification

AI-powered OCR extracts data from passports, IDs, and driver licenses from 200+ countries. Automatic fraud detection for altered or fake documents.

Built-in identity verification with Sumsub and Shufti Pro pre-integrated in Codono. Document verification, liveness detection, sanctions screening, and Travel Rule поддержка:ready to deploy with your API keys.

One-time license • Deploy in 3-7 days • Lifetime updates

Email Verified

Your email has been confirmed

Just add your API keys in admin panel:no additional development required

Pre-integrated providers ready to use, plus additional интеграцияs available

Additional KYC providers can be integrated at nominal pricing. Contact us for custom requirements.

AI-powered OCR extracts data from passports, IDs, and driver licenses from 200+ countries. Automatic fraud detection for altered or fake documents.

Prevent spoofing with real-time selfie verification. Challenge-response система ensures the person is physically present during verification.

Real-time screening against global watchlists including OFAC, EU sanctions, UN lists, and PEP databases. Continuous monitoring for status changes.

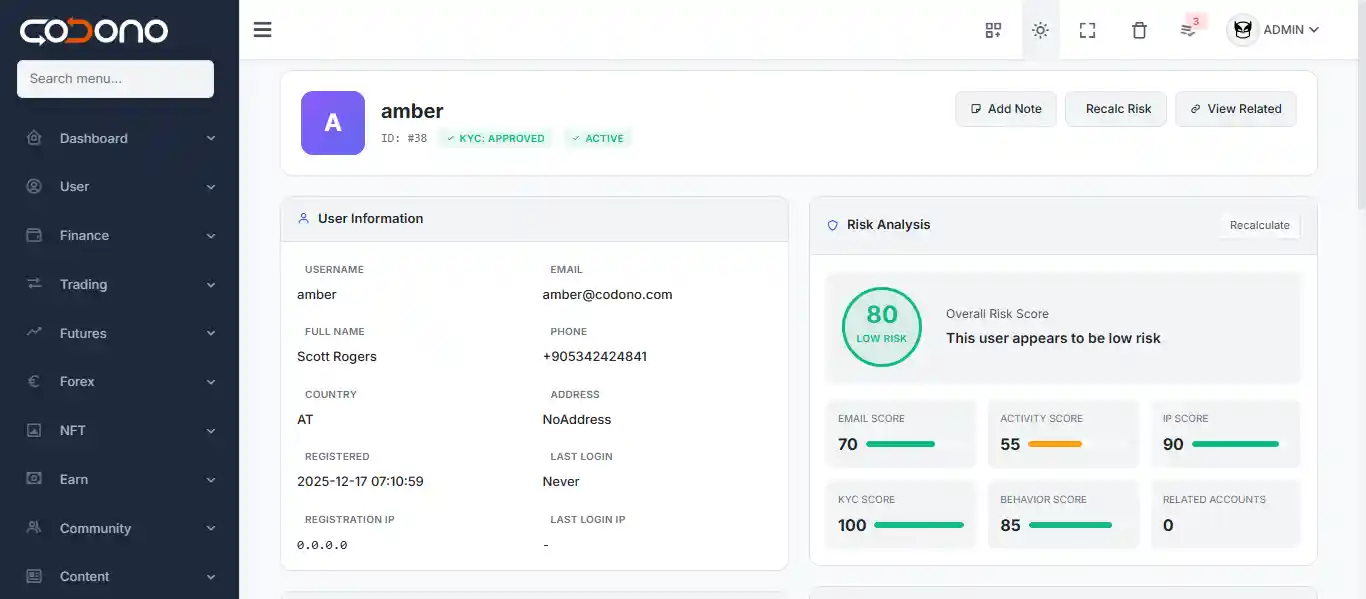

Automated risk assessment based on user location, transaction patterns, and wallet history. Configurable risk thresholds trigger enhanced due diligence.

Automated VASP-to-VASP information sharing for cross-border transactions. Configurable threshold amounts per jurisdiction.

Continuous monitoring of user transactions for suspicious patterns. Automatic flagging of high-risk activities with configurable alerts.

Set different requirements and limits for each verification level

All tier requirements, limits, and names are fully customizable via admin panel

Efficient tools for your compliance team to review and process verifications

Sumsub and Shufti Pro are fully integrated out of the box:just add your API keys and you're ready to go. Both поддержка document verification, liveness detection, and AML screening in 200+ countries.

Yes, we can integrate any KYC/AML provider at nominal pricing. Popular options include Jumio, Onfido, Veriff, Trulioo, IDnow, Persona, Socure, and Au10tix. The modular architecture makes adding new providers straightforward.

Configure multiple verification levels with different requirements and withdrawal limits. For example: Tier 1 (email only, $500 limit), Tier 2 (ID + selfie, $10k limit), Tier 3 (full KYC + proof of address, unlimited). All tiers are customizable from the admin panel.

Yes, the module includes Travel Rule поддержка for VASP-to-VASP information sharing. Configure threshold amounts per jurisdiction and automate data collection for transactions above limits.

Supports passports, national IDs, driver's licenses, and residence permits from 200+ countries. Proof of address accepts utility bills, bank statements, and government correspondence. OCR extracts data automatically.

Полный source code access means you can modify every aspect: the user interface, verification steps, document requirements, risk scoring algorithms, and admin review workflows. No vendor lock-in.

Sumsub & Shufti Pro pre-integrated, tiered verification система, and full source code. Deploy compliant exchanges in days.