White Label Crypto Exchange Software

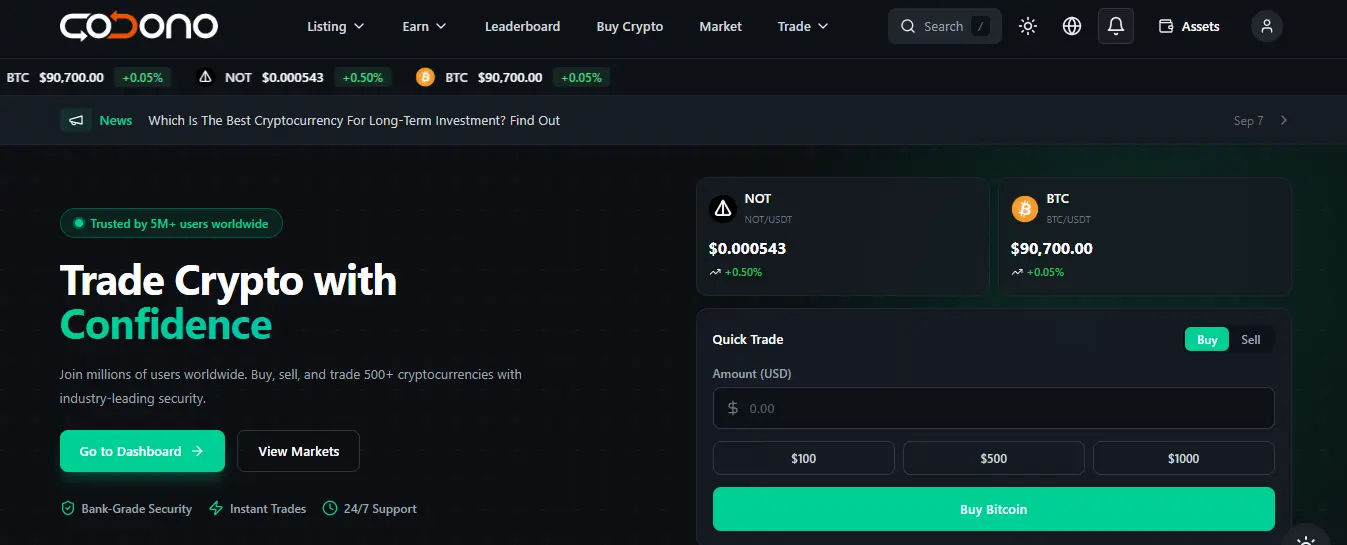

Launch a fully branded cryptocurrency exchange under your own domain, your own logo, and your own fee structure. Codono's white label platform gives you a production-ready trading infrastructure that deploys in 14 days, not 14 months. Full source code. One-time payment. No revenue sharing.

What Is White Label Crypto Exchange Software?

White label crypto exchange software is a complete, pre-built trading platform that you license, rebrand, and deploy as your own exchange. Instead of hiring a team of blockchain developers, security engineers, and frontend designers to build an exchange from scratch, you start with a battle-tested platform that already handles order matching, wallet management, user authentication, KYC verification, and every other component a live exchange requires.

The term "white label" means the software ships without branding. You apply your company name, logo, color palette, domain, and visual identity. When users visit your exchange, they see your brand, not the software provider's. The underlying technology is invisible to your users, the same way a restaurant's kitchen equipment supplier is invisible to diners.

What makes white label different from SaaS exchange platforms is ownership. With Codono, you receive the full source code. You host it on your servers. You control the data, the infrastructure, and the codebase. There are no monthly licensing fees, no revenue sharing agreements, and no dependency on a third party to keep your exchange running. If you want to modify the matching engine, add a custom trading feature, or integrate a specific payment provider, your team has complete access to do so.

This is how the majority of successful exchange operators launch. The technology is proven across hundreds of deployments. The operator focuses on what actually differentiates their business: market positioning, regulatory licensing, user acquisition, and liquidity development.

White Label vs Custom Build

Complete Feature Stack Included

Every component you need to run a professional exchange, ready on day one

Trading Engine

In-memory order matching with price-time priority. Supports limit, market, stop-loss, and stop-limit orders. Handles thousands of concurrent orders per second. The spot trading engine processes trades with sub-millisecond latency and emits real-time events via WebSocket for instant UI updates.

Wallet Infrastructure

Multi-chain wallet system with automated hot and cold storage management. Supports 50+ blockchains including Bitcoin, Ethereum, Solana, Tron, and all EVM networks. Configurable hot wallet thresholds, automated sweeps, and multi-signature security for cold storage transactions.

KYC & Compliance

Built-in KYC/AML system with tiered verification levels. Integrates with providers like SumSub for automated identity verification. Sanctions screening, transaction monitoring, and suspicious activity reporting support MiCA, FinCEN, and VARA compliance requirements.

Admin Dashboard

Comprehensive admin panel for managing every aspect of your exchange. User management, KYC approvals, trading pair configuration, fee settings, wallet monitoring, system health metrics, and financial reporting. Role-based access control lets you delegate tasks to support and compliance teams.

Mobile Applications

Native mobile apps for iOS and Android with real-time price feeds, order placement, portfolio tracking, push notifications, and biometric authentication. The mobile experience mirrors the web platform with full trading functionality. Your branding applied across every screen.

TradingView Charts

Professional-grade TradingView charting with 100+ technical indicators, drawing tools, and multiple timeframes. Candlestick, line, bar, and Heikin-Ashi chart types. Real-time data streaming. The charting library that professional traders expect as standard.

API & WebSocket

Full REST API and WebSocket infrastructure for algorithmic trading, market data streaming, and third-party integrations. Versioned endpoints, comprehensive documentation, rate limiting, and API key management. Supports trading bots, portfolio trackers, and data aggregators.

Liquidity Engine

Built-in liquidity aggregation that connects to external exchanges and market makers. Your order book shows competitive spreads from launch day without waiting for organic volume. Configurable aggregation rules and spread markup for revenue optimization.

Security Architecture

Enterprise-grade security with AES-256 encryption at rest, TLS 1.3 in transit, TOTP-based two-factor authentication, anti-phishing codes, device fingerprinting, IP whitelisting, withdrawal address whitelisting, and real-time anomaly detection. DDoS protection and rate limiting built in.

Expand Beyond Spot Trading

Add revenue-generating modules as your exchange grows

Margin Trading

Cross and isolated margin with configurable leverage up to 10x. Automated liquidation engine, margin call alerts, and risk management controls.

Futures & Perpetuals

Perpetual contracts with funding rates, insurance fund, and position management. 100x leverage on major pairs. The highest-revenue trading product per user.

P2P Trading

Peer-to-peer marketplace with escrow, dispute resolution, and 300+ payment methods. Direct fiat-to-crypto trading without exchange-held fiat reserves.

Forex Trading

50+ currency pairs and precious metals with leverage up to 1:500. Real-time price feeds from institutional LPs. Transform your crypto exchange into a multi-asset platform.

Staking Platform

Flexible and locked staking products with configurable APY. Support for proof-of-stake tokens. A passive revenue stream that increases user retention and deposits.

Token Launchpad

IEO and IDO platform for hosting token sales. KYC-gated participation, vesting schedules, and allocation management. Listing fee revenue plus new user acquisition from project communities.

Full Customization Control

Make the exchange truly yours with complete branding and configuration control

Visual Branding

- Company logo and favicon

- Primary and secondary color schemes

- Typography and font selection

- Email templates with your branding

- Mobile app splash screen and icons

- Custom landing pages and marketing pages

Trading Configuration

- Trading pair selection and base currencies

- Maker and taker fee structures per pair

- Minimum trade amounts and precision

- Leverage limits per asset class

- Order types enabled per market

- Trading competition and reward rules

Compliance Settings

- KYC verification tiers and requirements

- Withdrawal limits per verification level

- Restricted countries and IP geofencing

- AML monitoring thresholds

- Document types accepted per jurisdiction

- Terms of service and legal pages

Revenue Settings

- Fee schedules with VIP tier discounts

- Referral commission structures

- Listing fee pricing

- Withdrawal fee amounts per chain

- Staking APY and operator spread

- Fiat on-ramp markup percentages

From Purchase to Live Exchange in 14 Days

A proven deployment process refined across hundreds of exchange launches

Purchase & Setup

Choose your license plan, receive the full source code package, and provision your server infrastructure. Codono supports any Linux VPS or cloud provider.

Branding & Design

Apply your logo, color scheme, and brand identity across the trading platform, admin panel, mobile apps, and email templates. Full CSS and template customization.

Configuration

Set up trading pairs, fee structures, withdrawal limits, KYC tiers, and supported cryptocurrencies. Configure hot and cold wallet thresholds.

Integrations

Connect KYC providers, payment gateways, liquidity sources, and blockchain nodes. Test deposit and withdrawal flows for every supported chain.

Security & Testing

Configure SSL, DDoS protection, rate limiting, and 2FA. Run comprehensive testing including load tests, security scans, and wallet transaction verification.

Launch

Deploy to production, configure DNS, enable monitoring and alerting, seed initial liquidity, and open registration. Go live with full confidence.

Cost Comparison: White Label vs Custom Development

The economics of building versus buying exchange infrastructure

White label delivers the same functional outcome at roughly 2% of the cost and 10x faster. The engineering risk is eliminated because the software is already proven in production across hundreds of live exchanges. Your investment goes into building the business, not rebuilding solved technical problems.

View Pricing PlansBuilt-In Revenue Streams

Multiple monetization channels configured through the admin panel

Trading Fees

Earn 0.1% to 0.3% on every spot trade executed. With $1M daily volume at 0.2% average fee, that generates $2,000 per day in revenue.

Withdrawal Fees

Charge flat or percentage-based fees on cryptocurrency and fiat withdrawals. Operators typically earn $500 to $2,000 per day from withdrawal fees alone.

Listing Fees

New token projects pay $5,000 to $50,000 for exchange listings. A growing exchange can list 2-4 tokens per month, adding $10,000 to $200,000 in monthly revenue.

Margin & Futures Fees

Leveraged trading generates 5x to 20x higher fee revenue per dollar of exposure. Funding rates on perpetual contracts add continuous 8-hourly revenue.

Staking & Earn

Offer staking and yield products, keeping a spread on the APY paid to users versus what the protocol earns. Typical operator margins are 1% to 3% APY.

Fiat On-Ramp Spread

Mark up the spread on fiat-to-crypto purchases via card payments. Card purchase markups of 1% to 3% generate significant revenue from new user onboarding.

A mid-size exchange processing $2M in daily volume across spot, margin, and futures typically generates $4,000 to $12,000 per day in combined fee revenue. Read our detailed breakdown of crypto exchange revenue models for realistic projections by exchange size.

Regulatory Compliance Built In

Exchange licensing is no longer optional. Whether you are targeting the European Union under MiCA, registering as a Money Services Business with FinCEN in the United States, or applying for a VARA license in Dubai, regulators expect your technology platform to enforce compliance rules automatically.

Codono's white label platform includes the compliance infrastructure that regulators look for during the licensing process. Tiered KYC verification, transaction monitoring, suspicious activity flagging, sanctions screening, and comprehensive audit trails are built into the core platform.

The compliance module adapts to your specific regulatory requirements. Configure which documents are required at each verification tier, set withdrawal limits by KYC level, restrict access by jurisdiction, and generate the reports that compliance officers and regulators need.

Operators who have gone through the licensing process with Codono report that having a fully featured compliance system in the technology platform significantly accelerates regulatory approval. The technology audit portion of the licensing process is straightforward when the platform already implements industry-standard compliance controls.

Supported Frameworks

- MiCA (EU) — CASP registration requirements

- FinCEN (US) — MSB compliance controls

- VARA (Dubai) — Virtual asset regulations

- MAS (Singapore) — Payment services requirements

- FCA (UK) — Crypto asset registration

- AUSTRAC (Australia) — Digital currency exchange rules

Frequently Asked Questions

Common questions about white label crypto exchange software

What is white label crypto exchange software?

White label crypto exchange software is a pre-built, fully functional trading platform that you rebrand and deploy as your own. It includes the trading engine, wallet infrastructure, KYC system, admin panel, and mobile apps. You customize the branding, domain, fee structure, and trading pairs. The result is an exchange that looks and operates as if your team built it from scratch, without the 12-18 month development timeline.

How long does it take to launch a white label exchange?

Most operators launch within 14 to 21 days. The first week covers server provisioning, domain configuration, branding customization, and trading pair setup. The second week focuses on KYC provider integration, payment gateway configuration, wallet testing, and security hardening. Complex deployments with custom features may take up to 30 days.

How much does white label exchange software cost compared to custom development?

White label solutions from Codono start at $3,899 as a one-time license fee with no monthly charges or revenue sharing. Custom exchange development typically costs $200,000 to $500,000 and takes 12 to 18 months. The total first-year cost difference is roughly 50x, and white label launches 10x faster.

Do I get the full source code?

Yes. Codono provides complete source code for the backend, frontend, admin panel, and mobile apps. You can modify any component, add custom features, integrate third-party services, and audit the entire codebase. There is no vendor lock-in. You host the software on your own infrastructure and control every aspect of the deployment.

Can I customize the design and branding?

Every visual element is customizable. You control the logo, color scheme, typography, page layouts, email templates, and mobile app branding. The trading interface, registration flow, dashboard, and all user-facing pages can be themed to match your brand identity. CSS and template files are fully accessible in the source code.

What trading features are included?

The platform includes spot trading with limit, market, and stop orders, margin trading with configurable leverage, P2P trading, OTC desk, futures and perpetual contracts, staking, earn modules, and a launchpad for token sales. TradingView charts are integrated for professional charting. The matching engine handles thousands of orders per second.

How many blockchains and tokens does it support?

Codono supports 50-plus blockchains natively including Bitcoin, Ethereum, BNB Chain, Solana, Tron, Polygon, Avalanche, Arbitrum, and all EVM-compatible networks. You can list thousands of tokens across these chains. Adding new tokens is done through the admin panel without code changes. New blockchain integrations can be added through the modular wallet system.

Is the software compliant with regulations like MiCA?

The platform includes built-in compliance tools: KYC identity verification with providers like SumSub, AML transaction monitoring, sanctions screening, suspicious activity reporting, and configurable withdrawal limits by verification tier. These features support compliance with MiCA, FinCEN MSB requirements, VARA regulations, and other frameworks. You configure the compliance rules for your specific jurisdiction.

What ongoing support is provided after launch?

Codono provides technical support, software updates, security patches, and new feature releases. Support covers deployment issues, configuration questions, and technical troubleshooting. Since you have full source code, your development team can also make changes independently. Documentation, API references, and deployment guides are included.

Can I add forex trading and derivatives to the platform?

Yes. Codono offers a forex trading module that adds 50-plus currency pairs and precious metals with configurable leverage up to 1:500. The futures module supports perpetual contracts with funding rates, insurance fund, and liquidation engine. These modules integrate with the same user accounts, wallets, and admin panel, creating a unified multi-asset trading platform.

Launch Your Exchange in 14 Days

Get the complete white label crypto exchange platform with full source code, 50+ blockchain integrations, mobile apps, and dedicated deployment support. One-time payment starting at $3,899.