Collateralized Loans

Users borrow against their crypto holdings. Configure LTV ratios, interest rates, and supported collateral assets via admin panel.

Add crypto-backed lending services to your exchange. Let users borrow against their holdings or earn interest by lending. Full admin controls, automated liquidation, and risk management included with source code.

Complete lending infrastructure for your crypto exchange platform

Users borrow against their crypto holdings. Configure LTV ratios, interest rates, and supported collateral assets via admin panel.

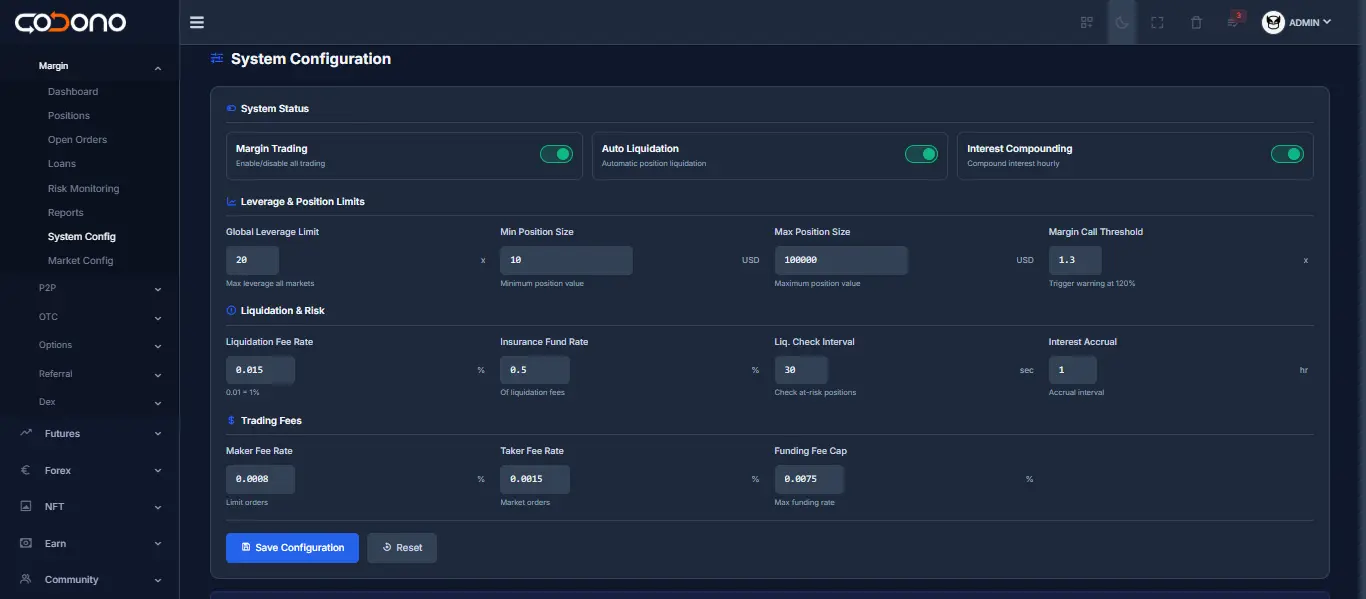

Enable margin trading with lending pools. Users can borrow to amplify positions with configurable leverage limits.

Built-in liquidation engine monitors positions and automatically liquidates undercollateralized loans to protect lenders.

Set fixed or variable interest rates per asset. Configure hourly, daily, or custom compounding schedules.

Users can lend their assets to earn interest. Manage pool sizes, utilization rates, and lender rewards.

Set margin call thresholds, liquidation penalties, and position limits. Real-time monitoring dashboard for operators.

Set up collateral assets, LTV ratios, interest rates, and liquidation thresholds via admin panel.

Supply capital directly or enable peer-to-peer lending where users deposit assets to earn interest.

Users deposit collateral and receive loans. Interest accrues automatically based on your configured rates.

System monitors collateral values, sends margin call alerts, and executes liquidations when needed.

See how lending works on your platform

This calculator demonstrates the user-facing lending interface. All rates and LTV limits are configurable from your admin panel.

You have options: fund loans from your operational capital, enable peer-to-peer lending where users supply liquidity, or both. The admin panel lets you configure lending pools and set interest rates for lenders.

When a loan's collateral value drops below the configured liquidation threshold (e.g., 80% LTV), the system automatically sells collateral to repay the loan. You configure thresholds, penalties, and can set up margin call notifications.

Yes. Each asset can have its own interest rate, LTV ratio, and collateral eligibility. Adjust rates dynamically based on utilization or market conditions.

The system includes full audit trails, transaction logging, and reporting tools. Interest accrual and loan terms are transparent and documented for compliance requirements.

Yes. The lending module powers margin trading by providing borrowed funds for leveraged positions. Users can also take standalone collateralized loans outside of trading.

The lending module is included with Codono exchange software. Get full source code, admin controls, and automated risk management ready for deployment.