How to Start a Cryptocurrency Exchange Business

Everything you need to launch a crypto exchange in 2026. This guide covers market analysis, business planning, regulatory licensing, technology selection, security architecture, liquidity strategy, compliance integration, and go-to-market execution. Written from the experience of supporting 100+ exchange launches across 50+ countries.

Why Start a Crypto Exchange in 2026?

The cryptocurrency market in 2026 is fundamentally different from five years ago. Regulatory frameworks have matured across the EU (MiCA), UAE (VARA), Singapore (MAS), and dozens of other jurisdictions. Institutional adoption has moved from experimental allocations to strategic portfolio positions. Bitcoin ETFs have brought hundreds of billions in new capital into the ecosystem.

This regulatory clarity creates an opportunity that did not exist before. Licensed exchanges now have clear competitive advantages: banking partnerships, fiat on-ramp access, institutional client eligibility, and the ability to market legally. The era of unregulated grey-area exchanges is ending, replaced by a professional market where compliant operators thrive.

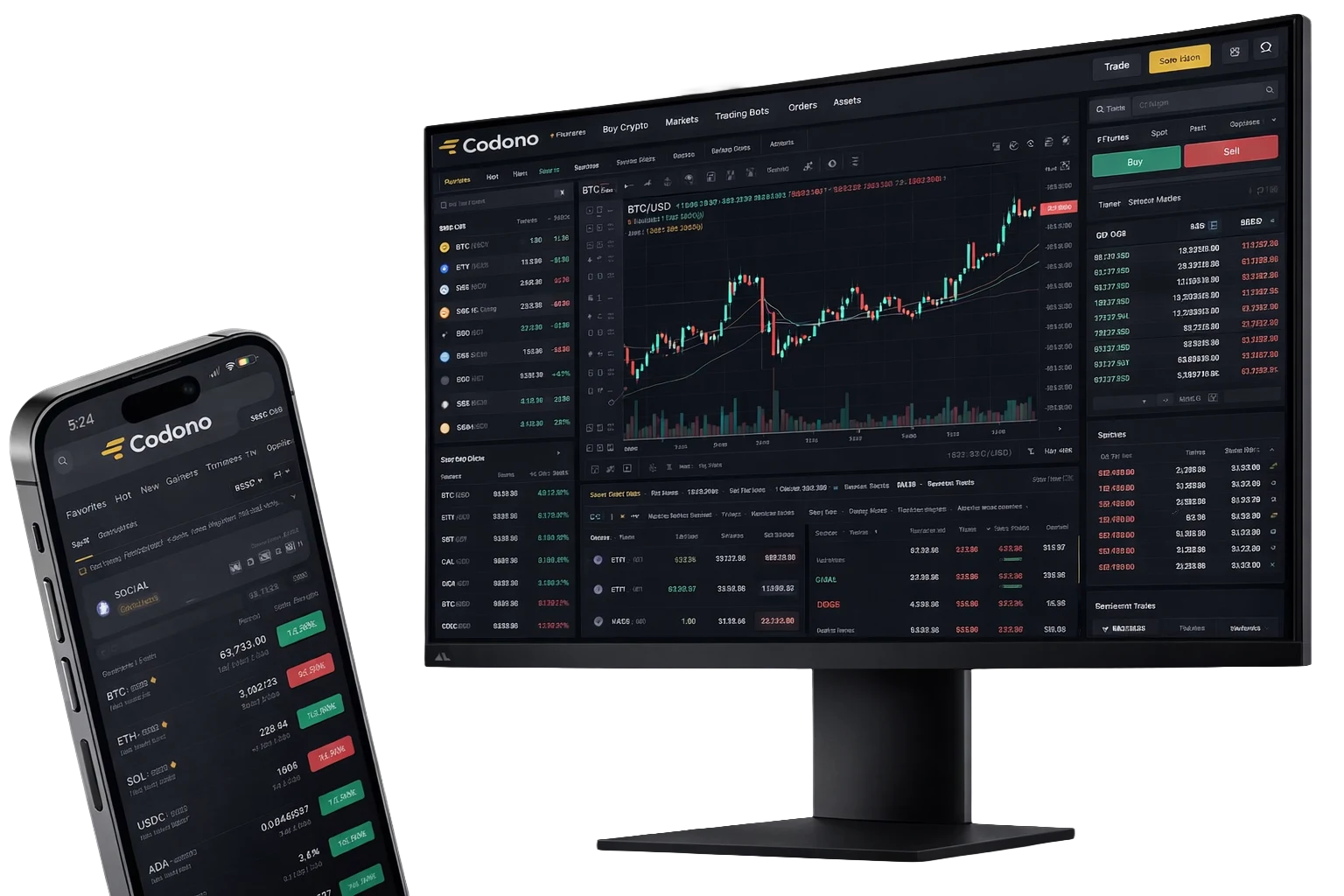

The technology barrier has also collapsed. What required a $500,000 development budget and 18 months of engineering in 2020 is now available as white-label exchange software deployable in two weeks. You focus on the business. The technology is solved.

- 600M+ crypto users globally, growing 20-30% annually

- Clear regulatory frameworks in 50+ countries

- White-label technology eliminates the engineering barrier

- Multiple revenue streams: fees, listings, staking, margin

- Regional exchanges serving local markets are underrepresented

Choose Your Exchange Model

Each model serves different markets and generates revenue differently

Spot Exchange

The core product. Users buy and sell cryptocurrencies at market prices. Supports limit, market, and stop orders. Revenue comes from maker/taker trading fees. This is where every exchange starts.

Learn about spot tradingFutures & Derivatives

Perpetual contracts with leverage up to 100x. Generates 5-20x higher fee revenue per dollar of exposure compared to spot. Requires more sophisticated risk management and liquidation infrastructure.

Learn about futuresP2P Exchange

Users trade directly with each other using escrow. Supports 300+ payment methods including bank transfer, mobile money, and cash. Ideal for markets with limited banking access or fiat restrictions.

Learn about P2PMulti-Asset Platform

Combine crypto with forex, precious metals, and commodities. Serve traders who want a single platform for all asset classes. Higher revenue per user and stronger retention.

Learn about forexMost operators start with spot trading and add additional modules as their user base grows. Codono supports all models with the same core platform, so you can expand without rebuilding.

8-Step Roadmap to Launch

A proven process refined across 100+ exchange deployments

Market Research & Business Planning

Before writing a single line of code or choosing software, understand the market you are entering. Define your target geography, user demographics, and exchange model.

- Identify your target market and underserved regions

- Choose exchange model: spot, derivatives, P2P, or multi-asset

- Analyze competitors in your target geography

- Create financial projections with realistic volume assumptions

- Determine initial capitalization requirements

- Define your unique value proposition

Legal Structure & Licensing

Register your business entity in a suitable jurisdiction and begin the regulatory licensing process. This step takes the longest and should start as early as possible.

- Choose business registration jurisdiction

- Engage crypto-specialized legal counsel

- Apply for required licenses (MSB, VASP, etc.)

- Draft Terms of Service and Privacy Policy

- Establish compliance officer role

- Set up corporate banking relationships

Technology Selection & Setup

Choose between white-label exchange software and custom development. For 95% of new operators, white-label delivers better outcomes faster and at a fraction of the cost.

- Evaluate white-label vs custom development

- Select exchange software provider

- Provision server infrastructure

- Configure domain and SSL certificates

- Set up development and staging environments

- Plan customization and branding work

Branding & Customization

Apply your brand identity to every touchpoint: trading interface, mobile apps, email templates, and landing pages. Your exchange should look and feel uniquely yours.

- Design logo and brand identity system

- Apply color scheme and typography

- Customize email and notification templates

- Create landing pages and marketing content

- Configure mobile app branding and icons

- Set up custom domain with branding

Security Implementation

Security is not optional. Deploy multi-layered protection before a single user creates an account. One breach can end your exchange permanently.

- Configure cold and hot wallet architecture

- Deploy two-factor authentication (TOTP)

- Set up DDoS protection and rate limiting

- Implement withdrawal address whitelisting

- Configure IP monitoring and device fingerprinting

- Establish incident response procedures

Compliance Integration

Integrate KYC identity verification and AML monitoring. Configure verification tiers, withdrawal limits, and sanctions screening for your regulatory requirements.

- Select and integrate KYC provider (e.g., SumSub)

- Configure verification tiers and document requirements

- Set withdrawal limits per verification level

- Enable AML transaction monitoring

- Configure sanctions and PEP screening

- Set up suspicious activity reporting

Liquidity & Market Configuration

No users means no liquidity. No liquidity means no users. Break this cycle by connecting to external liquidity sources before launch.

- Connect to liquidity aggregators

- Configure market maker integrations

- Set up initial trading pairs and base currencies

- Configure fee schedules (maker/taker)

- Set up referral and affiliate programs

- Test order book depth and spread quality

Testing & Launch

Run comprehensive testing. Start with a soft launch to a limited group, gather feedback, fix issues, then scale to full public launch with marketing support.

- Full security audit and penetration testing

- Load testing for high-traffic scenarios

- End-to-end deposit and withdrawal testing

- Soft launch with limited user group

- Gather feedback and iterate

- Full public launch with marketing campaign

Choosing Your Exchange Technology

This is the single most impactful decision you will make. It determines your time to market, your first-year costs, and your technical risk profile.

Custom Development

- Budget: $200,000 - $500,000+

- Timeline: 12 to 18 months

- Team required: 8-15 engineers

- Full architectural control

- High risk: no production track record

- Ongoing maintenance: $10,000-30,000/month

White-Label Software

- Budget: $3,899 - $9,999 (one-time)

- Timeline: 14 to 21 days

- No development team required

- Full source code ownership

- Battle-tested across 100+ deployments

- Updates and security patches included

For 95% of new exchange operators, white-label software is the correct choice. The technology risk is eliminated, and you launch 10x faster at 2% of the cost. The only scenario where custom development makes sense is when you need a fundamentally different architecture that no existing solution provides.

Security Architecture for Your Exchange

Exchange security is non-negotiable. One breach ends your business permanently.

Wallet Security

Hot and cold wallet separation with 90-95% of funds in offline cold storage. Multi-signature authorization for cold wallet transactions. Automated threshold monitoring and alerts. Read more about wallet architecture.

User Authentication

TOTP-based two-factor authentication, anti-phishing codes, device fingerprinting, login notifications, and session management. Withdrawal address whitelisting with 24-hour activation delays.

Infrastructure Protection

DDoS mitigation, Web Application Firewall (WAF), rate limiting on all endpoints, IP reputation scoring, and real-time anomaly detection. See full security features.

Data Security

AES-256 encryption at rest for sensitive data, TLS 1.3 for all data in transit, encrypted database backups, and PCI-DSS aligned card data handling for fiat integrations.

Best Jurisdictions for Exchange Licensing

Compare regulatory environments, costs, and timelines

Licensing requirements evolve regularly. Always consult with a crypto-specialized legal firm in your target jurisdiction. For a deeper guide, read How to Get a Crypto Exchange License.

Realistic Cost Breakdown

What it actually costs to start and run a crypto exchange in 2026

Start with Codono's white-label platform from $3,899. One-time payment, no monthly software fees, no revenue sharing.

View Pricing PlansRevenue Potential of a Crypto Exchange

How exchanges generate revenue from day one

Trading Fees

The primary revenue source. Charge 0.1-0.3% on each trade. At $1M daily volume with 0.2% average fee, that generates $2,000/day ($730K/year). Volume compounds as you add users and trading pairs.

Withdrawal Fees

Flat fees per withdrawal per blockchain (e.g., $2 per BTC withdrawal, $1 per ETH). With 500 daily withdrawals averaging $1.50 each, that adds $750/day to revenue.

Token Listing Fees

New projects pay $5,000 to $50,000 for exchange listing. A growing exchange listing 2-3 tokens per month generates $10,000-150,000/month from listings alone.

Leverage Trading

Margin and futures generate 5-20x higher fees per dollar of exposure. A $100K leveraged trade at 20x generates fees on $2M notional. The highest revenue per user of any exchange product.

Staking & Earn

Offer staking products and keep a 1-3% spread on the APY. A staking platform with $5M in deposits at 2% spread generates $100K/year in passive revenue.

Fiat On-Ramp

Mark up card purchases by 1-3%. High-volume exchanges process $100K-1M/day in fiat deposits with 1.5% average markup, generating $1,500-15,000/day.

Conservative Revenue Projection

Projections based on aggregated data from Codono-powered exchanges across different markets. Actual results depend on jurisdiction, marketing investment, and competitive environment.

User Acquisition Strategies That Work

The most common failure mode for new exchanges is not technology. It is user acquisition. Building the exchange is the easy part. Filling it with active traders is the hard part. Here are strategies that successful Codono operators have used.

Geographic Focus

Target an underserved region where global exchanges do not offer local currency support, local payment methods, or local language. Southeast Asia, Africa, Latin America, and MENA all have fast-growing crypto markets with limited local exchange options. A regional exchange that offers local fiat rails and native language support captures demand that global platforms cannot.

Exclusive Token Listings

List tokens that are not available on major exchanges. Each new listing brings the token's community to your platform. Some operators generate 30-50% of their initial user base through strategic listings.

Trading Competitions

Run volume-based competitions with token prizes. Trading competitions create urgency, attract active traders, and generate concentrated volume spikes that improve order book depth. The cost is typically 5-10% of the fee revenue generated during the competition period.

Referral Programs

Commission-based referral programs where existing users earn a percentage of referee trading fees. The most effective programs offer 20-40% commission on trading fees for the referral lifetime. See user acquisition strategies for detailed playbooks.

Launch Checklist

- Business entity registered

- Legal counsel engaged

- Licensing application submitted

- Exchange software deployed

- Branding and customization complete

- KYC provider integrated

- Cold/hot wallets configured

- Security audit passed

- Liquidity sources connected

- Trading pairs configured

- Fee schedules set

- Terms of Service finalized

- Support system operational

- Monitoring and alerting active

- Soft launch with test users

- Marketing campaign ready

Frequently Asked Questions

Answers to the most common questions about starting a crypto exchange

How much does it cost to start a crypto exchange?

Starting a cryptocurrency exchange typically costs between $10,000 and $100,000 in the first year. White-label software like Codono starts at $3,899 as a one-time license. Additional costs include server hosting ($100-500/month), regulatory licensing ($5,000-100,000 depending on jurisdiction), KYC provider fees ($0.50-3 per verification), legal consultation ($2,000-20,000), and marketing ($5,000-50,000 for launch phase). Custom development pushes total costs to $300,000-800,000+.

Do I need a license to run a crypto exchange?

In most jurisdictions, yes. Regulatory requirements vary by country. The EU requires MiCA CASP registration. The US requires state-by-state Money Transmitter Licenses or FinCEN MSB registration. Dubai requires a VARA license. Singapore requires a MAS Payment Services license. Some jurisdictions like certain Caribbean nations have lighter requirements. Operating without proper licensing exposes you to legal risk, banking difficulties, and potential fines. Always engage local legal counsel before launching.

How long does it take to launch a crypto exchange?

The technology deployment takes 14 to 21 days with white-label software. However, regulatory licensing typically takes 3 to 12 months depending on jurisdiction. A realistic timeline including compliance, testing, and soft launch is 2 to 6 months for a fully compliant exchange. Some operators launch in crypto-friendly jurisdictions first and pursue additional licenses as the business grows.

What technology do I need to start a Bitcoin exchange?

A complete exchange requires an order matching engine, multi-chain wallet infrastructure, trading interface with professional charting, admin panel, KYC/AML system, API for trading bots, mobile apps, and security infrastructure. White-label solutions like Codono provide all these components pre-built and tested. You need secure hosting (cloud VPS or dedicated servers), SSL certificates, DDoS protection, and a domain name.

How do I get liquidity for my new crypto exchange?

There are five main approaches: (1) Connect to liquidity aggregators that pull orders from major exchanges. (2) Partner with professional market makers who provide continuous bid-ask quotes. (3) Use Codono's built-in liquidity engine to aggregate from external sources. (4) Run trading competitions and maker fee rebates to attract active traders. (5) List unique tokens that create exclusive demand on your platform. Most operators combine aggregated liquidity at launch with organic volume development over time.

Is it profitable to run a cryptocurrency exchange?

Yes, exchanges generate revenue from multiple streams: trading fees (0.1-0.3% per trade), withdrawal fees, listing fees ($5,000-50,000 per token), margin trading interest, futures funding rates, staking spreads, and fiat on-ramp markups. A mid-size exchange processing $2M daily volume at 0.2% average fees generates roughly $4,000 per day in trading fee revenue alone. Profitability depends on operational costs, user acquisition efficiency, and regulatory overhead.

What are the biggest challenges in starting a crypto exchange?

The five biggest challenges are: (1) Regulatory compliance and licensing costs. (2) Acquiring initial users and achieving liquidity critical mass. (3) Establishing banking relationships for fiat deposits and withdrawals. (4) Building user trust and security reputation in a competitive market. (5) Managing ongoing compliance as regulations evolve. Using proven white-label software eliminates the technical risk and lets you focus on these business challenges.

Can I start a crypto exchange without coding knowledge?

Yes. White-label exchange software provides a complete working platform with admin panels for managing all aspects of your exchange without coding. For basic operations including user management, trading pair configuration, KYC approvals, and fee settings, the admin dashboard handles everything. For deeper customization, hiring one or two developers is recommended, but it is not required for launch.

Which countries are best for starting a crypto exchange?

Popular jurisdictions include Dubai (VARA license, zero income tax), Estonia (EU MiCA pathway), Lithuania (quick crypto licensing), Singapore (MAS Payment Services Act), Switzerland (FINMA progressive framework), and several Caribbean nations with lighter requirements. The best jurisdiction depends on your target market, capital availability, and regulatory tolerance. Many operators register in a crypto-friendly jurisdiction while serving users globally.

What is the difference between a CEX and DEX, and which should I build?

A centralized exchange (CEX) offers custodial trading with fast execution, fiat support, regulatory compliance, and professional features. A decentralized exchange (DEX) uses smart contracts with no central operator. CEXs process 95% of all crypto volume because they deliver better user experience and support institutional requirements. Most new exchange businesses start with a CEX model because it generates more revenue, supports compliance, and serves a broader user base.

Ready to Start Your Crypto Exchange?

Launch your exchange with Codono's white-label platform. Full source code, 50+ blockchain integrations, mobile apps, and deployment support. One-time payment starting at $3,899. No monthly fees. No revenue sharing. Deploy in 14-21 days.